BY JUDY HUA AND MANOLO SERAPIO JR

BEIJING/MANILA: China's gold reserves rose by nearly 19 tonnes in July from June, the central bank said on Friday, disclosing its holdings for the second time in two months in a move seen as a Beijing bid to increase transparency.

Before China announced its gold holdings for end-June last month, the last time it had adjusted its reserves figure was in April 2009.

The gold reserves stood at 53.93 million troy ounces by the end of July, up from 53.32 million at end-June, the central bank said, an increase of about 610,000 troy ounces or nearly 19 tonnes. The increase is equivalent to about $680 million at current prices.

"If they're now reporting every month and the numbers are different then it certainly does a lot for the transparency of the gold market in China," said Victor Thianpiriya, commodity strategist at ANZ Bank in Singapore.

China had previously considered its gold holdings a state secret and did not report its holdings on a monthly basis to the International Monetary Fund as most other countries do.

But Beijing has been campaigning for the IMF to include the yuan in its special drawing rights (SDR) basket, currently made up of dollars, yen, pounds and euros.

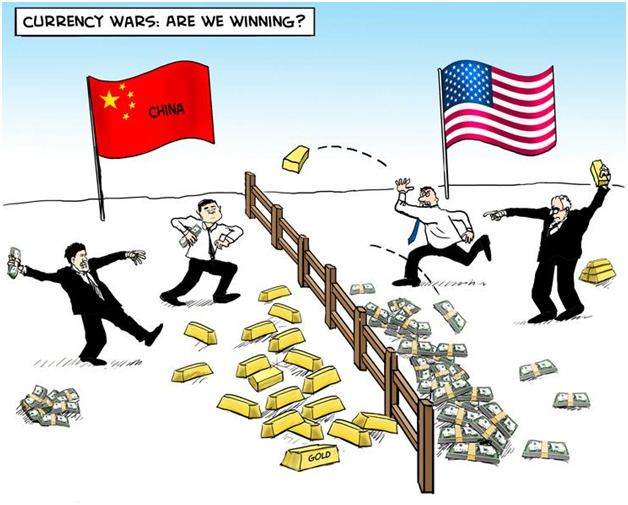

Earlier this week, China devalued the yuan in a move that shocked global markets and which critics saw as Beijing's bid to rescue its struggling exporters.

"It is possible China's devaluation was a pre-emptive move to stem the flow of funding back into the U.S. dollar," brokerage SP Angel said in a note.

China's latest disclosure of its gold reserves had little impact on spot prices, currently up 0.3 percent at $1,118.06 an ounce, and off Thursday's three-week peak of $1,126.31.

"The news is bullish at first glance, but the monthly volume of 19 tonnes is maybe less than some would have expected," Commerzbank analyst Carsten Fritsch told the Reuters Global Gold Forum.

AFP