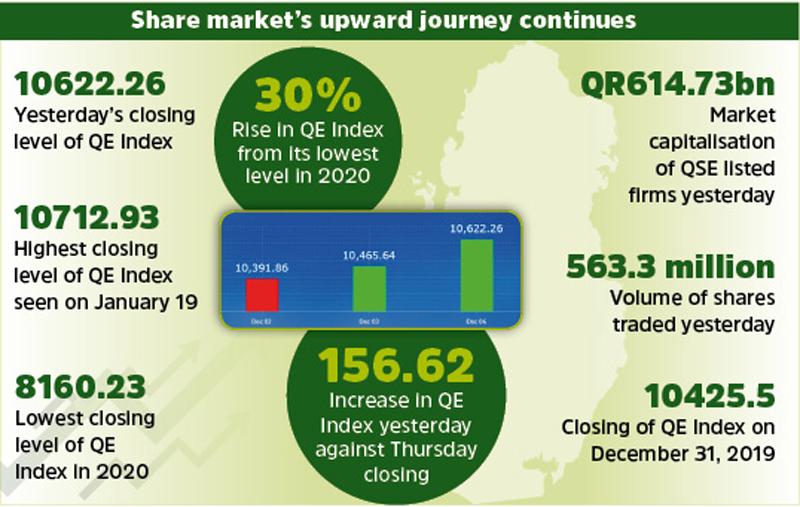

Qatari shares reached a new milestone yesterday as the Qatar Stock Exchange (QE) Index surged 156.62 points to close at 10,622.26 points, which is 10-month high for the index. The consistent rally in the stock market has cemented hopes among investor that the QE Index may see new highs before the end of this year. The index has risen over 230 points in the last two trading sessions.

Shares had a fantastic trading session yesterday as the index opened at 10,465 points and touched 10,636 points within the first hour of trading. In the next few hours, the index touched intraday high of 10,647.51 and then eased a bit to close the day at 10,622 points.

The recent run up in Qatari equities is a result of a combination of good news coming from the regional and global front. According to analysts, the most important is the recent announcement regarding resolving the Gulf crisis, that has boosted investor’s confidence.

“The market rally is fuelled by positive news in the last few days, but the most important factor behind the rally is talks of solving Gulf crisis. Investors are putting money back into the stocks now because they are convinced that the solution to Gulf crisis is imminent. Overseas investors are also bullish on Qatari stocks,” Ahmed Akl (pictured), a Doha-based financial analyst told The Peninsula.

“Global news has also supported the stock market. The world has covered much distance in fight against coronavirus. Earlier the discussions were regarding finding the vaccines, but now countries are finalising dates for administering the vaccines. In the US, it is now clear that the transition of power to the President elect will be smooth, which means stability in the market,” he added.

The upward journey of the stock market so far has been replete with several milestones. The QE Index has surged over 30 percent or over 2,460 points from March when it had fallen to 8,160 points -the lowest point of the year.

Also, the index has risen over 620 points in November, making it the best monthly performance since start of this year. The index had started the year on positive note as it had closed on January 2, which was the first trading session of the year, at 10,511 points against the closing of 10,425 points on December 31, which was the last trading day of 2019.

The Index continued its upward journey during in the coming days and closed at 10,712 points on January 19, which was the highest level of the year.